Location

Mayfair & St. James's

Size

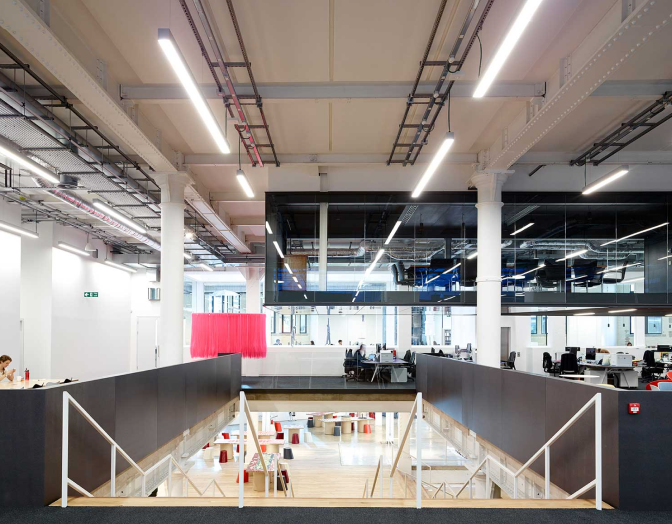

25,000 sq ft + 13,000 sq ft

Transaction Type

Lease restructure, expansion, disposal.

How did Rebase add value?

We reported potential relocation options and hosted various tours to analyze the market against staying in 16 Babmaes Street. We identified an off-market solution to expand on the ground floor to accommodate future growth. Since merging with London & Capital we have launched a lease surrender process. Dilapidations advice was required for a subtenants exit and on L&C’s disposal.

What was the result?

We reduced the rent by £500k per annum from the landlords opening offer and secured a capital contribution of £180,000 to upgrade their current accommodation. Since their last rent review, the market had risen 27% we mitigated their uplift to 7% which was very satisfactory.

Waverton Investment Management has a long-standing relationship with Rebase which we recently extended to support our property strategy following the merger of Waverton / London & Capital. This included a review of both entities existing property arrangements and future office requirements for the combined business. As with any property exercise navigating the various competing priorities of the lessee and lessor can be challenging/complex however leveraging the Rebase team’s knowledge of the market experience and counsel have helped L&C Waverton to achieve a position where we are confidently looking ahead.